Ajaaya Development Foundation

Micro Support| Macro Development

Ajaaya Development Foundation

Micro Support... Macro Development...

Vision

To be the preferred provider of unsecured loans to support small borrowers in India for their development

Mission

To provide customer centric lending solutions to the bottom of the pyramid customers, while maintaining high levels of employee engagement and corporate governance

Vision

To be the preferred provider of unsecured loans to support small borrowers in India for their development

Mission

To provide customer centric lending solutions to the bottom of the pyramid customers while maintaining high levels of employee engagement and corporate governance

Promoters

This start-up being launched by NBFC MFI professionals who has got more than 45 + years of cumulative experience in Banking & Finance.

About Us

This start-up being launched by NBFC MFI professionals who has got more than 45 + years of cumulative experience in Banking & Finance.

About Us

This start-up being launched by NBFC MFI professionals who has got more than 45 + years of cumulative experience in Banking & Finance.

About Us

This start-up being launched by NBFC MFI professionals who has got more than 45 + years of cumulative experience in Banking & Finance.

Promoters and Board

This start-up being launched by NBFC MFI professionals who has got more than 45 + years of cumulative experience in Banking & Finance.

He has 13+ years experience in Microfinance industry and had worked as Deputy COO in the second largest MFI in india. Expertise in managing operations, business expansion and people management

Both the directors had worked together for about 10 years in the same company and built it from day one.

20 years microfinance experience in leadership roles & 14 years of banking experience Built and managed large MFIs from scratch which currently have an AUM in excess of Rs.5,000 crores Pioneered the first mobile technology in MFI space International microfinance experience.

Has 23 years of experience in various field of social work on the welfare of children, women and family. This experiences helped her to have good network with NGOs and Social Institutions which helps in the field of MFI for helping Special need people.

He is a seasoned operations professional who has a thorough knowledge of South India Microfinance. He had handled sizeable portfolio in various MFIs and also an expert in manpower management

Why to start now

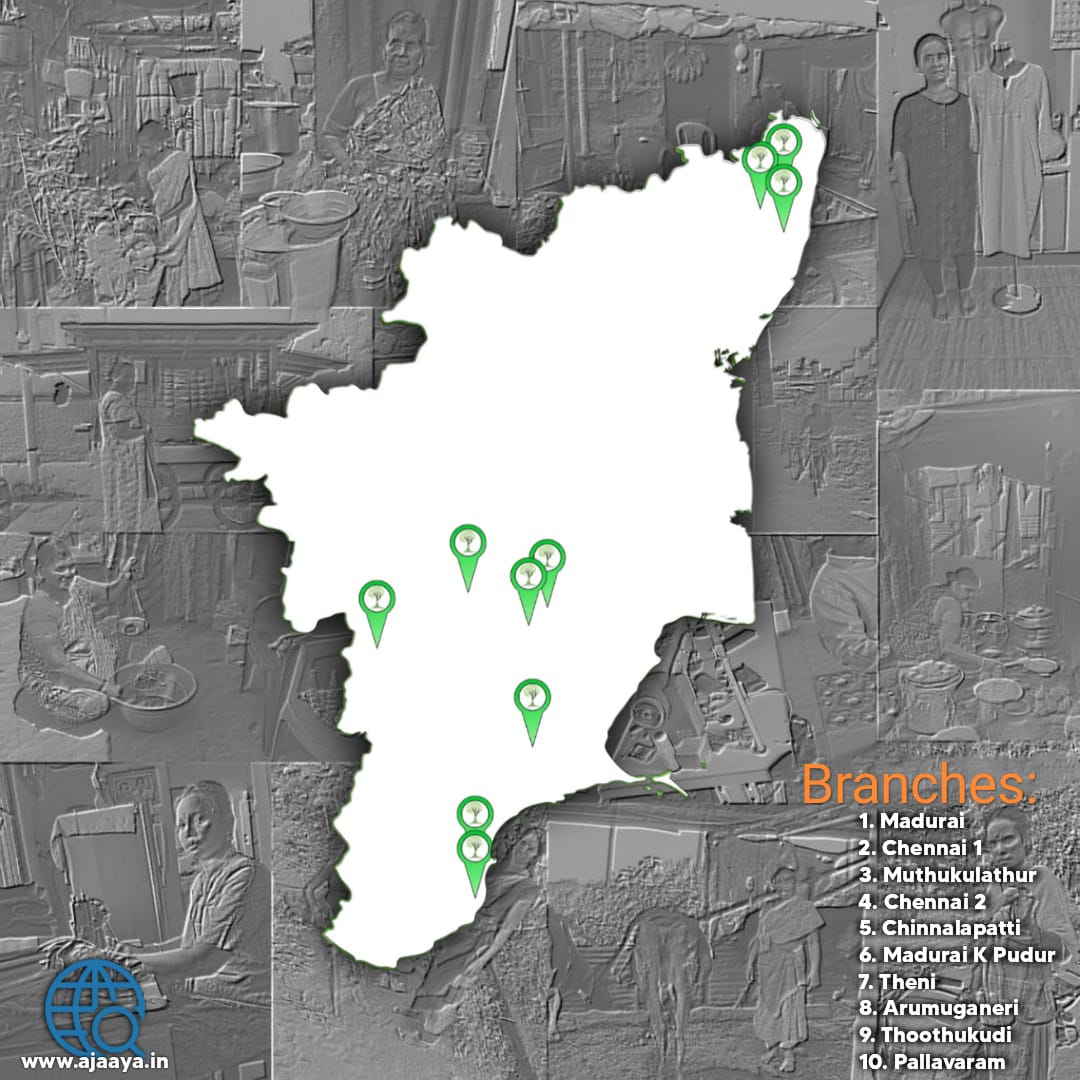

Our target clients will be below the pyramid, unbanked clients in rural and semi urban areas

Our Business Model

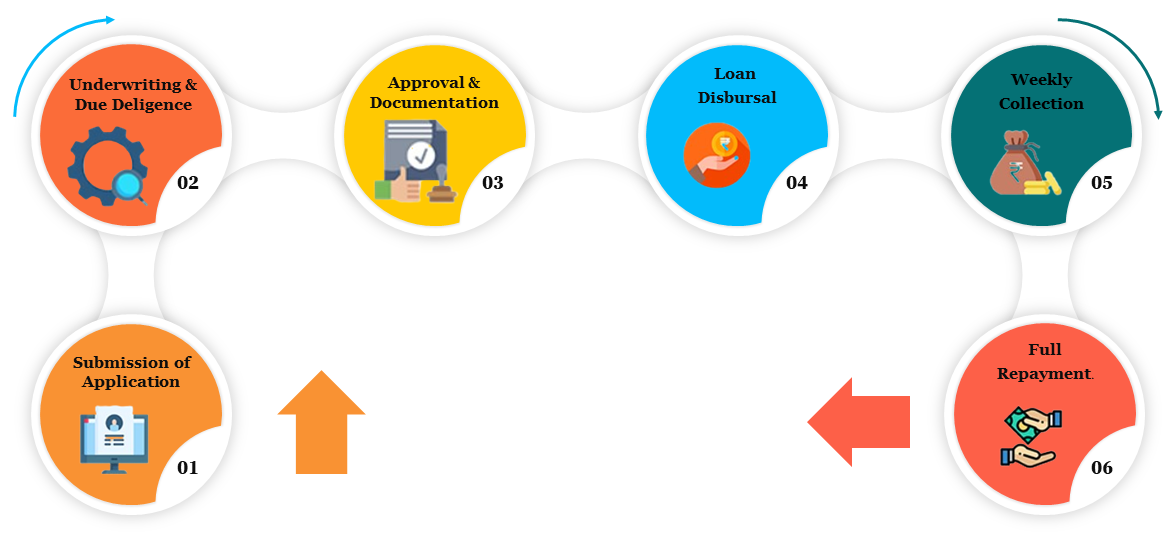

Disbursal in 3 days from the date of receipt of KYC along with loan application, friendly customer approach, no fore closure penalty, no delay collection penalty, eminent and effective software with mobile application to clients to manage the loan, digital collection wherever possible are some of the keys to manage competition and penetrate the market Our expected growth rate would be 20% year on year with no dividend pay-out for the first 3 years of operation.

Industry Partners

What Our Students Have to Say